Our funds have been designed for your clients who want to harness the power of investment markets to have a positive influence on society and the planet.

CCLA is bringing its unique approach to environmental, social and governance (ESG) factors to individual and professional investors for the first time. Today, our funds are recognised as consistent strong performers and this, combined with our 60-year history of pioneering sustainable investment for charities, the church and local authorities, has seen CCLA grow to become the largest charity fund manager in the UK.

ESG considerations are incorporated into our decision-making process and guides our commitment to engage for positive change on the world’s most pressing issues, from climate change to modern slavery and mental health.

Our funds

Get in touch

If you would like to find out more about our Better World fund range, contact our team.

Email: Intermediary.Team@ccla.co.uk

Investment approach

Our investment approach seeks to provide your clients with:

- Access to high-quality companies with recurring, growing cash flows

- Companies and assets with attractive valuations

- Strategies that offer sector and geographic diversification

- Tried-and-tested approach that ensures portfolios are consistent with our mission to build a Better World.

- Access to a highly experienced investment team

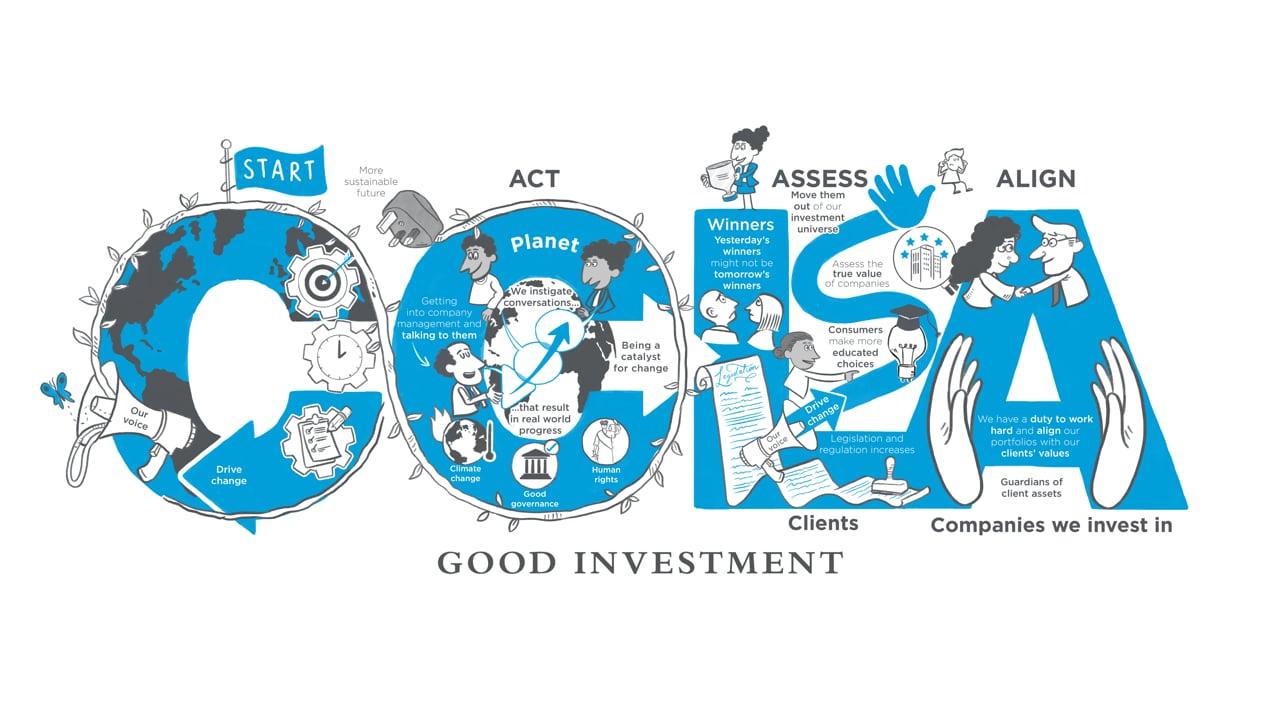

Good Investment underpins our investment philosophy

Our Sustainable Investment Framework

How do we quantify quality?

Portfolio construction

We aim to identify important trends that are driven by fundamental changes in the economy and couple this with detailed analysis of each prospective investment.

We pay little attention to the composition of any index against which a fund may be compared. We follow a clear, repeatable investment process that, we believe, identifies quality assets which will help deliver above average growth, trading at attractive valuations.

We believe that we can create long-term value for investors by selecting companies with the following characteristics:

Above average cash growth

Companies positioned in a growing market, making them well placed to increase in value.

Efficient capital allocation

Companies with a track record of wise capital allocation decisions shown through management’s skill to invest and distribute cash flows.

Predictable cash generation

Companies that have plentiful opportunities for future growth, typically operating in areas of the market less affected by short-term trends.

Financial strength

Companies with high-quality management teams and strong balance sheets that are well-run and resilient.

Enduring competitive advantage

Companies that demonstrate enduring competitive advantages, quantitatively measured on their cash flow return on investment and track record.

Meets or exceeds ESG minimum criteria

Companies operating above our minimum ESG standards.

Why choose CCLA?

Save with purpose

Investing is an effective way to put your money to work and potentially build wealth. Our approach to investing responsibly is to deliver positive change.

Invest in our collective future

Healthy markets require a healthy future, and CCLA is pushing for progress to meet the world’s sustainability challenges.

Target systemic issues

CCLA seeks to be a catalyst for change in the investment industry. By actively addressing sustainability challenges, we aim to limit risks before they negatively impact on the performance of our investors’ assets and the function of society.

Contact us

Jasper Berens

Head of Client Relationships and Distribution

Sam Pennefather

Head of Intermediary Sales

Samuel Lynes

Senior Sales Manager

Alexandra Dacres-Hogg

Sales Manager

Ella Smith

Strategic Partnerships Manager